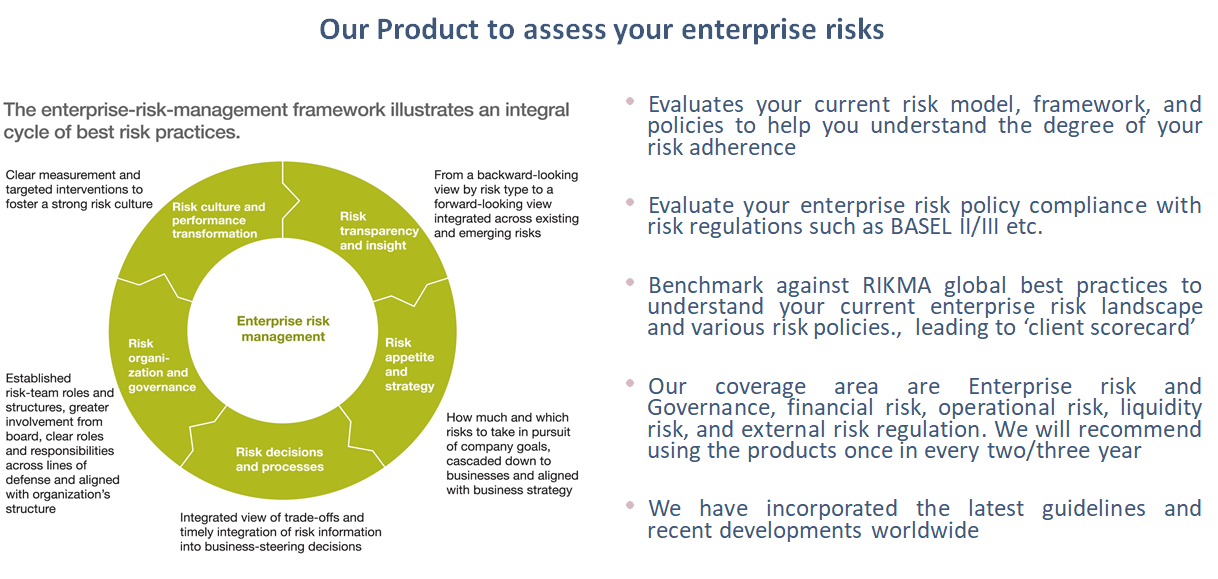

ERE - Enterprise Risk Evaluator: The four key aspect of an organization are strategy, execution and operation, enterprise risk, and technology. We drive organization through leadership, and we evaluate the governance and decisions through lenses of law, finance, risk, and ethics. History and the recent meltdown in the global economy taught us to treat risk management and ethics as part of our business strategy and value creator. The better approach to achieve the value creation is through the coupling of risk management and ethics with business strategy. Assess your current risk model and policies to help you understand where you stand today. We use parametric approach with two pivots such as ‘criticality as per client’ and criticality as per RIKMA’. Our coverage area are Enterprise risk & Governance, market risk, credit risk, operational risk, liquidity risk and external risk regulation such as BASEL II/III +, FSA etc.

| Six Enterprise risk areas | Six Enterprise risk areas – Credit risk, Market risk, Operational risk, Liquidity risk, Enterprise risk and governance, Risk Compliance | Reports and graphs |

| Dashboard to monitor work-in-progress | 1,650 + risk metrics and continually updated | Drill down features and analytics |

| Risk allocation per requirement | Risk metrics can be introduced based on Client requirements | Provides comprehensive report on strong & best performance area and weak & low performance area |

| Cloud product and no implementation | Scorecard | Helps you analyze and take corrective actions and thereby reduces your capital and resource costs |